Businesses in Thailand That Do Not Require a Foreign Business License (FBL)

Exclusive Summary Foreign Business License (FBL) under the Foreign Business Act (FBA). It provides guidance for foreign investors to explore these options, leveraging specific legal frameworks and incentives. Key exemptions include: BOI-Promoted Companies: Businesses in high-tech, digital industries, and renewable energy can enjoy tax benefits, work permits, and land ownership without needing an FBL. U.S. […]

Who and what to do when being audited on the issue of Transfer Pricing?

Are you a foreign tax resident in Thailand? Here are the pending changes in tax legislation regarding foreign sourced income that you need to be aware of.

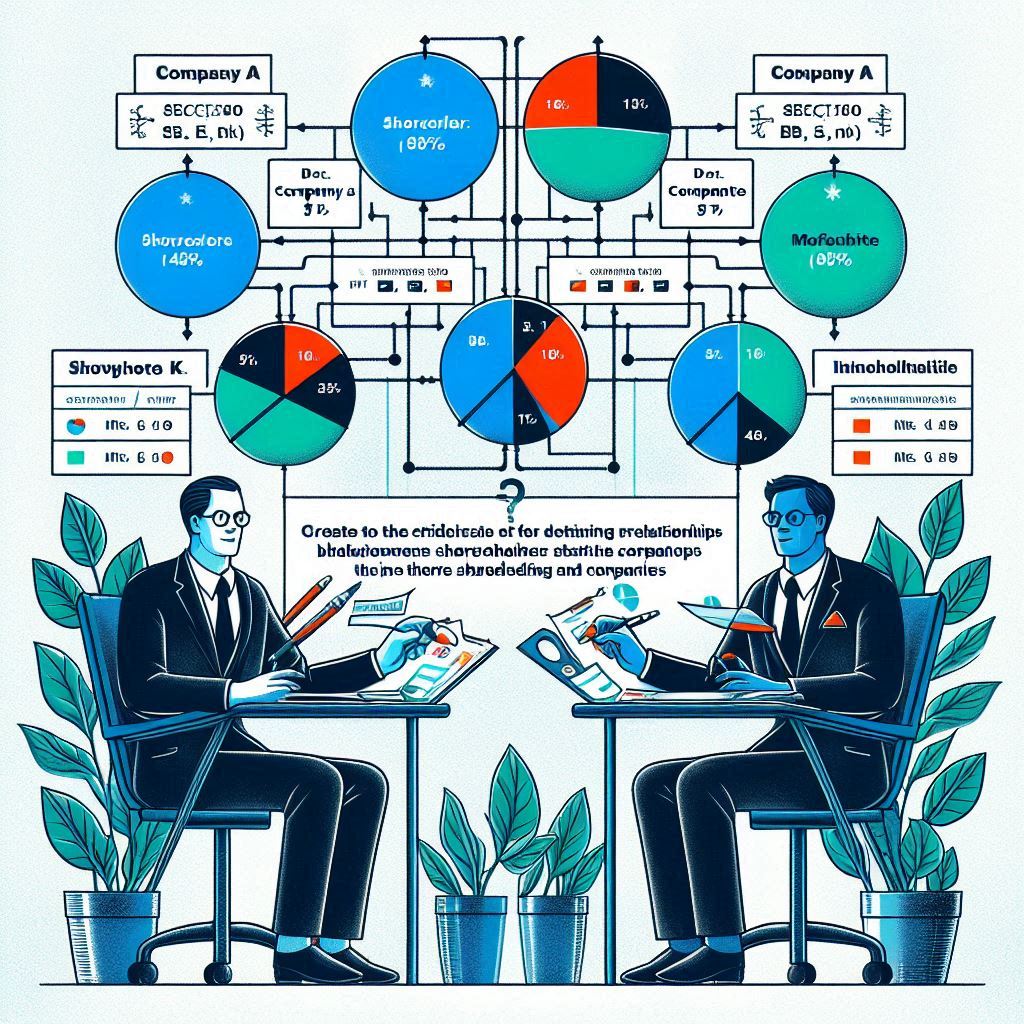

Shareholders who are individuals and the consideration of related companies

Are you a foreign tax resident in Thailand? Here are the pending changes in tax legislation regarding foreign sourced income that you need to be aware of.

Notification of the Director-General of Revenue Department on TAX (No.407)

Notification of the Director-General of the Revenue Department regarding Income Tax (No. 407): Prescrip

Advance Pricing Agreement (APA)

Are you a foreign tax resident in Thailand? Here are the pending changes in tax legislation regarding foreign sourced income that you need to be aware of.

Legal Guidelines | Procedures for Dividend Payment

Are you a foreign tax resident in Thailand? Here are the pending changes in tax legislation regarding foreign sourced income that you need to be aware of.

Welcomed changes to Company Law – Mergers without new Company creation or liquidation

On 1 January 1925, the Civil and Commercial Code (‘CCC’) of Thailand became effective and introduced various rules and procedures concerning for the legal affairs and rights of natural and legal ‘persons’ covering areas such as family law, inheritance law, contract law, property law, corporate law, commercial law and more. With respect to companies, the […]

Cyber Threats 2023

Common attackers rather than crime organization Cyberattacks are carried out by hackers who belong to local groups or operate independently. Most of the hackers operating in North America and Europe are young, with the majority having no financial motive for their actions. Ransomware targets move to Europe Ransomware remains a serious threat to businesses worldwide, […]

Are you keeping pace with new and increasing Cyber Security threats in 2023?

As technologies advance, artificial intelligence develops, and algorithms become more complex it is not surprising that there is doubt from security executives that although legacy antivirus tools are still in widespread use as the main solution against computer virus attacks, whether they will hold up in the modern world and be able to deal with […]

PEGASUS: Cyber Warfare

‘T’was the night before Songkran, and all through the house, not a creature was stirring, except …” the Pegasus spyware working quietly and invisibly in the background on your devices and copying all your personal information and data to a computer server in some foreign country… while your sleep soundly in your bed, completely unaware […]