“Royalties” Under Section 70 of the Thai Revenue Code

“Royalties” ค่าสิทธิ

Section 70 of the Thai Revenue Code

Section 70 of the Revenue Code stipulates that any payment of royalties made from or in Thailand to a company or juristic partnership established under foreign law and not carrying on business in Thailand is subject to withholding tax.

Who and what to do when being audited on the issue of Transfer Pricing?

Are you a foreign tax resident in Thailand? Here are the pending changes in tax legislation regarding foreign sourced income that you need to be aware of.

Shareholders who are individuals and the consideration of related companies

Are you a foreign tax resident in Thailand? Here are the pending changes in tax legislation regarding foreign sourced income that you need to be aware of.

Notification of the Director-General of Revenue Department on TAX (No.407)

Notification of the Director-General of the Revenue Department regarding Income Tax (No. 407): Prescrip

Advance Pricing Agreement (APA)

Are you a foreign tax resident in Thailand? Here are the pending changes in tax legislation regarding foreign sourced income that you need to be aware of.

Transfer Pricing: Overview, Exposures and Risks Webinar

As businesses expand across borders, the issue of transfer pricing becomes increasingly important. This webinar will cover the essentials of transfer pricing and provide practical advice for compliance.

Transfer Pricing: Overview, Exposures and Risks Webinar

As businesses expand across borders, the issue of transfer pricing becomes increasingly important. This webinar will cover the essentials of transfer pricing and provide practical advice for compliance.

New Guidelines: Individual shareholders can cause companies to be related

Thailand follows the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations (‘OECD Guidelines’), and as such, the Thai Revenue Code (‘TRC’) places reporting obligations on certain companies (and juristic partnerships) which have related party transactions. These can include a Transfer Pricing Disclosure Form, Local File, and Country by Country reporting. It is therefore […]

Update from the Thai Revenue Department regarding the Transfer Pricing Disclosure Form

On 28 March 2022, the Thai Revenue Department (“TRD”) published a Notification of Ministry of Finance regarding TPDF filing deadline extension for FY 2020. Moreover, the TRD also recently issued additional explanation and Q&A for the Transfer Pricing Disclosure Form (“TPDF”) on its TRD website. We have summarised key points as follows: TPDF filing deadline extension […]

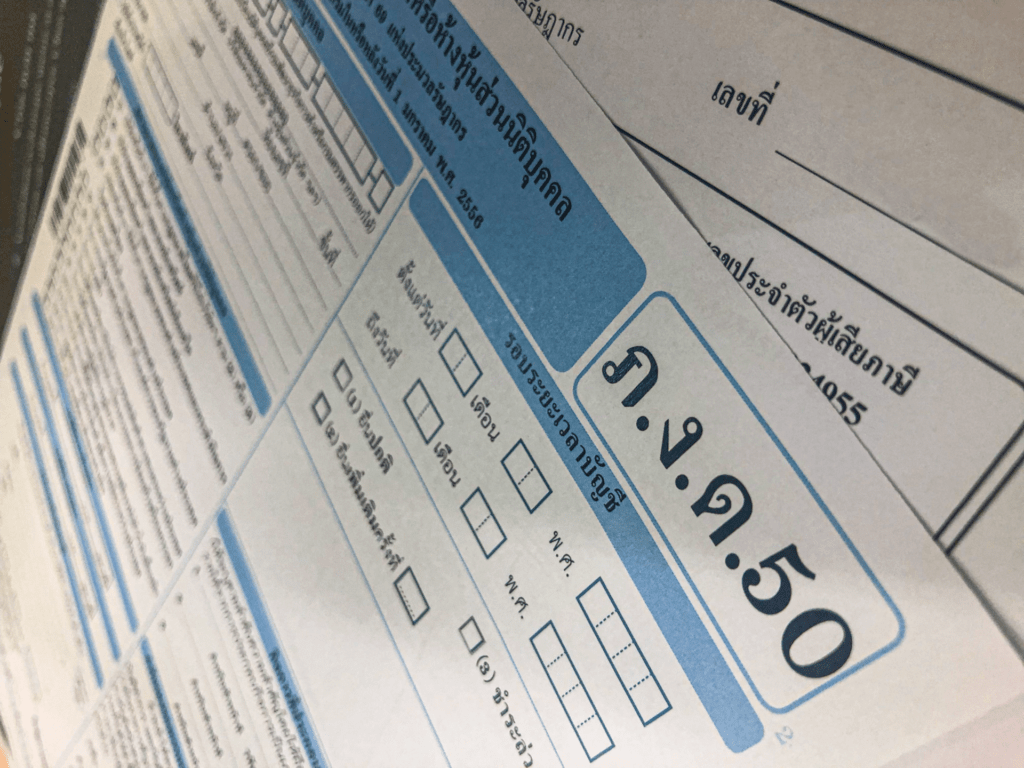

Tax Flash: PND 50 / TP Disclosure Form

Filing an annual Corporate Income Tax Return (PND 50) A company or juristic partnership, having its accounting period ended 31 December 2021, is required to submit its audited financial statements and corporate income tax return (PND 50) to the Thai Revenue Department (TRD) within 150 days following the end of the accounting period i.e., on […]