Summary of Change in the Civil and Commercial Code No 23

On November 8, 2022, the Civil and Commercial Code (“CCC”) No 23 was published in the Government Gazette and will come into force after 90 days after the date publishing in the government gazette i.e., February 7, 2023. Below is the summary of change to the Civil and Commercial Code which made on the Company […]

Effective Time Management

Tick tock, tick tock …how fast the seconds, minutes, and hours race by. A distraction, a sudden phone call, a new more interesting email to deal with… these can all disrupt our work and before we know it, another few hours have been lost. Where does the time go!!! With only a fixed number of […]

Making More of Your Data

In today’s connected World, as companies, industries and countries recover from the rigours of Coronavirus, those that emerge fastest and strongest are likely to be data driven. Thoughtful use of data and analytics can help companies execute changes quickly and effectively in the market. PKF is able and ready to help clients address a range […]

New Guidelines: Individual shareholders can cause companies to be related

Thailand follows the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations (‘OECD Guidelines’), and as such, the Thai Revenue Code (‘TRC’) places reporting obligations on certain companies (and juristic partnerships) which have related party transactions. These can include a Transfer Pricing Disclosure Form, Local File, and Country by Country reporting. It is therefore […]

Are you ready for PDPA?

The Personal Data Protection Act or PDPA will come into force on 1 June 2022. With the introduction of the Act so close, your organisation should be preparing for its requirements. However, if your company hasn’t yet started preparing for the PDPA’s requirements, we suggest below four steps which could jumpstart the compliance process. Let’s […]

Update from the Thai Revenue Department regarding the Transfer Pricing Disclosure Form

On 28 March 2022, the Thai Revenue Department (“TRD”) published a Notification of Ministry of Finance regarding TPDF filing deadline extension for FY 2020. Moreover, the TRD also recently issued additional explanation and Q&A for the Transfer Pricing Disclosure Form (“TPDF”) on its TRD website. We have summarised key points as follows: TPDF filing deadline extension […]

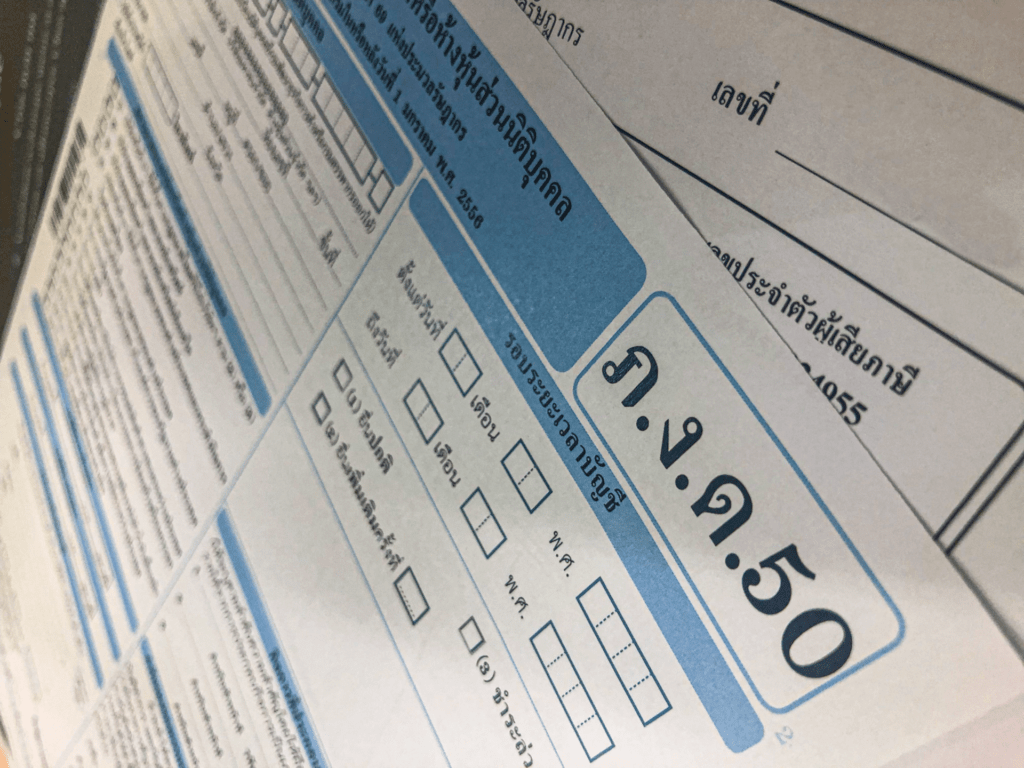

Tax Flash: PND 50 / TP Disclosure Form

Filing an annual Corporate Income Tax Return (PND 50) A company or juristic partnership, having its accounting period ended 31 December 2021, is required to submit its audited financial statements and corporate income tax return (PND 50) to the Thai Revenue Department (TRD) within 150 days following the end of the accounting period i.e., on […]

AGM 2022 : No Flexibility on the AGM Deadline this Year

Last year, 2021, the Department of Business Development (DBD) has granted flexibility regarding the deadline for holding the mandatory Annual General Meeting of Shareholders (AGM) in light of the disruption caused by the COVID-19 crisis. However, in this year, 2022, there is no such flexibility anymore. According to the guidelines for filing of the financial […]

Legal Updates: New Lending Services for Trade and Investment Support Offices (TISOs) and International Business Centres (IBCs)

The change in the scope to increase what TISOs and IBCs can do is very welcomed. These categories of business can now lend funds (in accordance with the exchange control regulations) to related companies both locally in Thailand and overseas.

Update on Information Exchange and Transfer Pricing Disclosure Form

On the path to enforce the Country-by-Country Reporting (CbCR) requirements in Thailand, there are a few developments regarding the TP rules in Thailand over the past month including the development of information exchange and the newer version of the Transfer Pricing Disclosure Form (TPDF).